4. Optimizing Marginal Revenue from the Demand Curve, Kaggle

Let’s have fun and model profit optimization using the demand curve. The data is take from Kaggle.

4.1. Load data

Let’s load the data.

[1]:

import pandas as pd

import numpy as np

df = pd.read_csv('./data/retail_price.csv') \

.assign(

month_year=lambda d: pd.to_datetime(d['month_year']),

year=lambda d: d['month_year'].dt.year,

month=lambda d: d['month_year'].dt.month,

weekend=lambda d: d['weekday'].apply(lambda x: 1 if x >= 5 else 0),

text=lambda d: d['product_category_name'].apply(lambda s: ' '.join(s.split('_')))

)

df.shape

[1]:

(676, 31)

4.2. Product categories

There are 9 product categories. Let’s model 9 demand curves corresponding to each of these product categories.

[2]:

df.rename(columns={'product_category_name': 'category'}) \

.groupby(['category', 'unit_price']) \

.size() \

.reset_index() \

.groupby(['category']) \

.size()

[2]:

category

bed_bath_table 26

computers_accessories 48

consoles_games 10

cool_stuff 18

furniture_decor 13

garden_tools 56

health_beauty 33

perfumery 14

watches_gifts 78

dtype: int64

4.3. Demand curves by category and price

Here, we shape the data by grouping records into product category and price.

[3]:

pq_df = df.groupby(['product_category_name', 'unit_price']) \

.agg(

q=pd.NamedAgg('qty', 'sum')

) \

.reset_index() \

.rename(columns={'unit_price': 'p', 'product_category_name': 'category'}) \

.set_index(['category']) \

.join(df \

.rename(columns={'product_category_name': 'category'}) \

.groupby(['category']) \

.agg(c=pd.NamedAgg('freight_price', 'mean'))

)

pq_df.shape

[3]:

(296, 3)

4.4. Optimal prices

The table below shows the optimal price for each product category.

[4]:

from sklearn.linear_model import LinearRegression

def get_mc(category):

return pq_df[pq_df.index==category].iloc[0].c

def get_Xy(category):

Xy = pq_df[pq_df.index==category]

X = Xy[['p']]

y = Xy['q']

return X, y

def get_model(X, y):

m = LinearRegression()

m.fit(X, y)

return m

def debug_params(model, mc):

b_0, b_1 = model.intercept_, model.coef_[0]

qp_params = f'{b_0:.5f} + {b_1:.5f}p'

z_0, z_1 = (-b_0 / b_1), (1 / b_1)

pq_params = f'{z_0:.5f} + {z_1:.5f}q'

tr_params = f'{z_0:.5f}q + {z_1:.5f}q^2'

z_0, z_1 = (-b_0 / b_1), 2 * (1 / b_1)

mr_params = f'{z_0:.5f} + {z_1:.5f}q'

z_0, z_1 = (-b_0 / b_1), 2 * (1 / b_1)

qo_params = f'({mc:.5f} - {z_0:.5f}) / {z_1:.5f}'

return {

'q': qp_params,

'p': pq_params,

'tr': tr_params,

'mr': mr_params,

'qo': qo_params

}

def get_params(model):

return pd.Series([model.intercept_, model.coef_[0]], ['b_0', 'b_1'])

def get_pq(b_0, b_1):

return lambda q: (-b_0 / b_1) + (1 / b_1) * q

def get_qp(b_0, b_1):

return lambda p: b_0 + (b_1 * p)

def get_mr(b_0, b_1):

return lambda q: (-b_0 / b_1) + (2 * (1 / b_1) * q)

def get_qo(b_0, b_1):

z_0 = (-b_0 / b_1)

z_1 = 2 * (1 / b_1)

return lambda mc: (mc - z_0) / z_1

def get_funcs(b_0, b_1):

pq = get_pq(b_0, b_1)

qp = get_qp(b_0, b_1)

mr = get_mr(b_0, b_1)

qo = get_qo(b_0, b_1)

r = lambda p, q: p * q

t = lambda p, q, mc: (p * q) - (mc * q)

return pq, qp, mr, qo, r, t

def get_opt(f, mc):

pq_f, qp_f, mr_f, qo_f, r_f, t_f = f

q_opt = qo_f(mc)

p_opt = pq_f(q_opt)

mr_opt = mr_f(q_opt)

r_opt = r_f(p_opt, q_opt)

t_opt = t_f(p_opt, q_opt, mc)

return pd.Series({

'mc': mc,

'p': p_opt,

'q': q_opt,

'mr': mr_opt,

'tr': r_opt,

'pr': t_opt

})

def optimize(category):

X, y = get_Xy(category)

m = get_model(X, y)

p = get_params(m)

f = get_funcs(p.b_0, p.b_1)

mc = get_mc(category)

return {**{'category': category}, **get_opt(f, mc).to_dict()}

The category computer_acessories is the outlier here with an optimal price recommended to be a negative price. We will see later that there is an outlier that causes this problem. The columns of the table below are as follows.

mcis marginal cost computed by taking the average cost (average freight cost of all the product items for the particular product catgeory and price point)pis the optimal priceqis the corresponding optimal quantitymris the corresponding marginal revenuetris the corresponding total revenuepris the corresponding profit

[5]:

opt_df = pd.DataFrame([optimize(c) for c in pq_df.index.unique()])

opt_df

[5]:

| category | mc | p | q | mr | tr | pr | |

|---|---|---|---|---|---|---|---|

| 0 | bed_bath_table | 16.139718 | 413.954170 | 21.954253 | 16.139718 | 9088.054630 | 8733.719184 |

| 1 | computers_accessories | 25.103741 | -27.221815 | 6.479547 | 25.103741 | -176.385023 | -339.045890 |

| 2 | consoles_games | 14.809415 | 26.068586 | 30.257496 | 14.809415 | 788.770143 | 340.674335 |

| 3 | cool_stuff | 18.975096 | 151.269261 | 24.424237 | 18.975096 | 3694.636306 | 3231.184067 |

| 4 | furniture_decor | 16.944617 | 222.175809 | 38.990538 | 16.944617 | 8662.754232 | 8002.074509 |

| 5 | garden_tools | 28.458310 | 99.268009 | 36.931818 | 28.458310 | 3666.148045 | 2615.130919 |

| 6 | health_beauty | 18.607448 | 849.975469 | 29.792779 | 18.607448 | 25323.131451 | 24768.763874 |

| 7 | perfumery | 14.336311 | 78.183209 | 30.772484 | 14.336311 | 2405.891570 | 1964.727677 |

| 8 | watches_gifts | 16.492840 | 159.459065 | 21.486980 | 16.492840 | 3426.293739 | 3071.912418 |

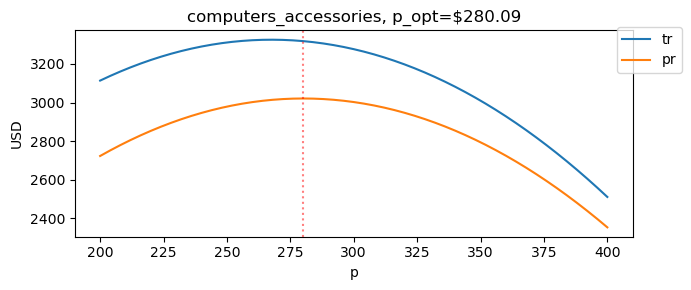

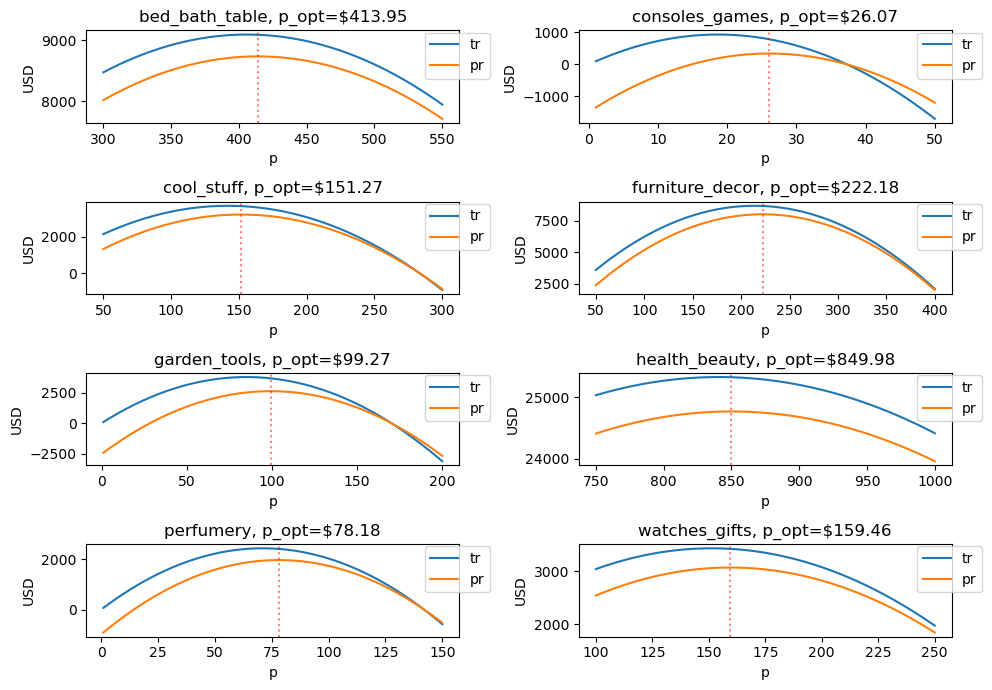

4.5. Visualizing optimal prices

Let’s visualize the total revenue and profit for each product category.

[6]:

import matplotlib.pyplot as plt

def plot_rev_profit_curves(category, min_p=1, max_p=800, ax=None):

X, y = get_Xy(category)

m = get_model(X, y)

p = get_params(m)

f = get_funcs(p.b_0, p.b_1)

mc = get_mc(category)

opt = get_opt(f, mc)

if ax is None:

fig, ax = plt.subplots(figsize=(7, 3))

else:

fig = None

pd.DataFrame({

'p': np.arange(min_p, max_p + 1, 1),

}).assign(

q=lambda d: f[1](d['p']),

tr=lambda d: d['p'] * d['q'],

mr=lambda d: f[2](d['q']),

pr=lambda d: f[5](d['p'], d['q'], mc)

) \

.set_index(['p'])[['tr', 'pr']] \

.plot(kind='line', ax=ax)

ax.axvline(x=opt.p, color='r', alpha=0.5, linestyle='dotted')

ax.legend(bbox_to_anchor=(1.1, 1.05))

ax.set_title(f'{category}, p_opt=${opt.p:.2f}')

ax.set_ylabel('USD')

if fig is not None:

fig.tight_layout()

[7]:

fig, axes = plt.subplots(4, 2, figsize=(10, 7))

categories = [

'bed_bath_table', 'consoles_games', 'cool_stuff', 'furniture_decor',

'garden_tools', 'health_beauty', 'perfumery', 'watches_gifts'

]

min_p = [

300, 1, 50, 50,

1, 750, 1, 100

]

max_p = [

550, 50, 300, 400,

200, 1_000, 150, 250

]

for c, _min_p, _max_p, ax in zip(categories, min_p, max_p, np.ravel(axes)):

plot_rev_profit_curves(c, min_p=_min_p, max_p=_max_p, ax=ax)

fig.tight_layout()

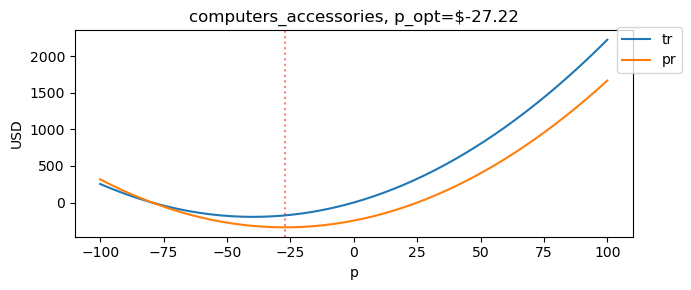

4.6. Computer accessories

Now, what’s wrong with the computers_accesories category? Notice that its total revenue and profit curves are convex (and not concave).

[8]:

plot_rev_profit_curves('computers_accessories', min_p=-100, max_p=100)

Let’s dig a big deeper.

[9]:

category = 'computers_accessories'

X, y = get_Xy(category)

m = get_model(X, y)

p = get_params(m)

f = get_funcs(p.b_0, p.b_1)

mc = get_mc(category)

opt = get_opt(f, mc)

[10]:

opt

[10]:

mc 25.103741

p -27.221815

q 6.479547

mr 25.103741

tr -176.385023

pr -339.045890

dtype: float64

Look at the relationships below. You will notice that the slopes of q and p are NOT negative but positive (that explains the convex curves).

[11]:

debug_params(m, mc)

[11]:

{'q': '9.85046 + 0.12383p',

'p': '-79.54737 + 8.07550q',

'tr': '-79.54737q + 8.07550q^2',

'mr': '-79.54737 + 16.15099q',

'qo': '(25.10374 - -79.54737) / 16.15099'}

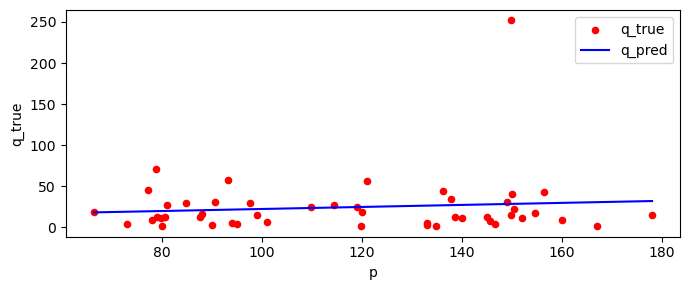

If we visually inspect the data (red dots are scatter plot of true quantity), we notice an outlier quantity around 250. The predicted curve from this data slopes up (positive slope, blue line).

[12]:

fig, ax = plt.subplots(figsize=(7, 3))

_temp = pq_df[pq_df.index==category] \

.assign(

q_true=lambda d: d['q'],

q_pred=lambda d: f[1](d['p'])

)[['p', 'q_true', 'q_pred']]

_temp.plot(kind='scatter', x='p', y='q_true', label='q_true', ax=ax, color='r')

_temp.plot(kind='line', x='p', y='q_pred', label='q_pred', ax=ax, color='b')

fig.tight_layout()

/opt/anaconda3/lib/python3.9/site-packages/pandas/plotting/_matplotlib/core.py:1114: UserWarning: No data for colormapping provided via 'c'. Parameters 'cmap' will be ignored

scatter = ax.scatter(

4.7. Remove outlier

Let’s simply remove the outlier and see what happens.

[13]:

Xy = pq_df[pq_df.index==category].query('q < 252')

X = Xy[['p']]

y = Xy['q']

m = get_model(X, y)

p = get_params(m)

f = get_funcs(p.b_0, p.b_1)

mc = get_mc(category)

opt = get_opt(f, mc)

[14]:

opt

[14]:

mc 25.103741

p 280.092646

q 11.847662

mr 25.103741

tr 3318.442913

pr 3021.022281

dtype: float64

The relationships look better (slopes are negative).

[15]:

debug_params(m, mc)

[15]:

{'q': '24.86173 + -0.04646p',

'p': '535.08155 + -21.52230q',

'tr': '535.08155q + -21.52230q^2',

'mr': '535.08155 + -43.04460q',

'qo': '(25.10374 - 535.08155) / -43.04460'}

The total revenue and profit curves are now concave.

[16]:

min_p, max_p = 200, 400

fig, ax = plt.subplots(figsize=(7, 3))

pd.DataFrame({

'p': np.arange(min_p, max_p + 1, 1),

}).assign(

q=lambda d: f[1](d['p']),

tr=lambda d: d['p'] * d['q'],

mr=lambda d: f[2](d['q']),

pr=lambda d: f[5](d['p'], d['q'], mc)

) \

.set_index(['p'])[['tr', 'pr']] \

.plot(kind='line', ax=ax)

ax.axvline(x=opt.p, color='r', alpha=0.5, linestyle='dotted')

ax.legend(bbox_to_anchor=(1.1, 1.05))

ax.set_title(f'{category}, p_opt=${opt.p:.2f}')

ax.set_ylabel('USD')

fig.tight_layout()